Disclosure: I have no positions in any stocks mentioned, and no plans to initiate any positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Overview

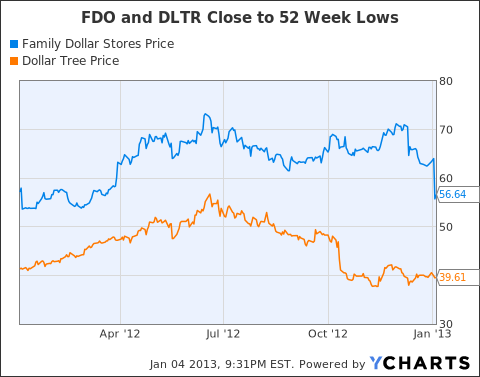

Recently, the dollar store industry in the US has been under significant pressure because of margin compression combined with the potential economic and employment recovery in the US, which could affect this counter-cyclical industry. Despite these headwinds, the two stocks in this article, both trade for reasonable valuations relative to their growth potential over the long term. As December's unemployment numbers show, unemployment in the US is at 7.8%, leaving the job market weak and thus many Americans turn to dollar stores for value. Additionally, the increase in payroll taxes means that Americans will have less money in their pockets to spend, which could also lead to increased business for dollar stores in general. Both stocks mentioned have traded lower in the past 52 weeks, have market caps of at least $6 Billion, and trade for no more than 15x estimated 2014 earnings. This list is meant as a base for further research.

FDO data by YCharts

Family Dollar (FDO)

Market Cap: $6.6 Billion

Dividend Yield: 1.48%

Estimated 2014 PE: 13.25x

As one of the largest dollar store chains in the US, Family Dollar operates over 7,500 locations in 45 US states, with 955 stores in Texas. Additionally, the company hopes to open 500 new stores in 2013. On January 3rd, Family Dollar reported its Q1 earnings for fiscal 2013 for the three months ended on November 24th 2012, which disappointed the Street, as net income came in slightly lower than the same period a year earlier. The company reported $80.28M in net income on $2.42B in sales for the quarter. Sales were up by 12.7% in the quarter, yet earnings were down due to compressed profit margins. In Q1 2012, Family Dollar reported net profit margins of 3.74%; however, Q1 2013 margins decreased by 42 bps to 3.32%. Additionally, gross margins decreased by 112 bps from 35.26% to 34.14%. This margin compression was due largely to increased costs. Additionally, Family Dollar has a dividend yield of 1.48%. The stock has sold off by nearly 20% over the past month and is worth further investigation by investors. The stock should benefit if the company is able to meaningfully increase profit margins.

Dollar Tree (DLTR)

Market Cap: $9 Billion

Estimated 2014 PE: 14.05x

Dollar Tree is another one of the largest dollar store companies in the US. The company currently operates 4,630 stores in the US and Canada. On November 15, 2012, Dollar Tree reported its Q3 earnings for the three months ending October 27, 2012. Excluding an one-time item, Dollar Tree grew its EPS by 18.6% to $0.51 when compared the same period in 2011. While not experiencing margin compression as much as Family Dollar, Dollar Tree's gross margin did decrease by 20 bps from 35.1% to 34.9%. In June of 2012, Dollar Tree completed a 2-for-1 stock split. Dollar Tree does not pay a dividend to shareholders. Dollar Tree has sold off by over 15% in the past three months. Similar to its peers, the company should benefit if it can improve its profit margins going forward.

shea weber greystone sidney crosby at the drive in alternative minimum tax modeselektor gran torino

কোন মন্তব্য নেই:

একটি মন্তব্য পোস্ট করুন